If you end up dropping monitor of your price range close to the top of the month, don’t fear, you’re not alone! Many individuals discover it difficult to stay to a price range as a result of they don’t know tips on how to plan it correctly or don’t have the behavior of controlling their spending. Both method, studying tips on how to plan your price range extra successfully will allow you to lower your expenses and dwell a extra stress-free life.

Listed below are 5 tips about tips on how to plan your price range the best method!

5 Methods to Save Cash and Funds Successfully

1. Perceive Your Revenue

Step one to creating an efficient price range plan is to know all corners of your revenue. Take into account that the revenue charge you’re right here is the sum of money you get to maintain after tax deductions. Ensure to think about all revenue sources, together with any hustles you will have, alimonies, pursuits, youngster assist, or rental revenue.

Even when your month-to-month revenue varies from month to month, attempt to be as correct as potential in these calculations.

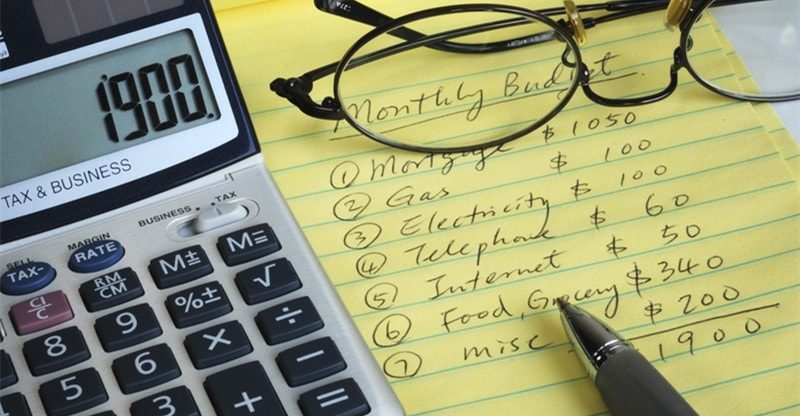

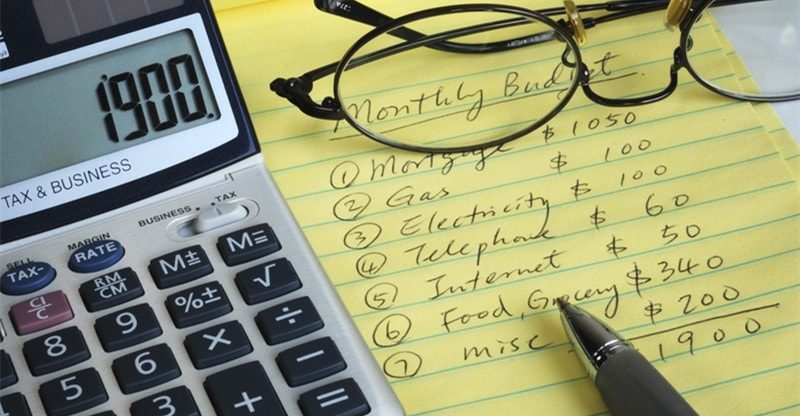

2. Calculate Your Bills

When you’ve decided how a lot revenue you may have left after taxes every month, check out everybody’s least favourite class – the bills. You should use any budgeting device and even make your personal excel sheet to categorize your bills. The classes ought to embrace housing, meals, leisure, emergency fund, and optionally available teams reminiscent of journey bills, hobbies, and many others.

You must evaluation your expense classes every month as a result of they’re extra more likely to range than your revenue information. Once more, attempt to be as particular and correct as potential.

3. Determine Out the Distinction

Now that you’ve got each your revenue and your bills discovered, calculate the distinction between them. That is the sum of money you should have left after you cowl all of your month-to-month bills. If you happen to’re not pleased with the quantity you bought, return to the bills class and see the place you may make some financial savings.

Maybe minimize down in your leisure spending or search for extra budget-friendly plans. You can too take into account establishing one other revenue stream, though that is far more difficult than simply controlling your spending.

4. Manage Your Financial savings

After getting the distinction between your revenue and bills, that sum of money will make up your financial savings account.

Merely placing cash apart and calling it “financial savings” received’t be of a lot use, particularly since many individuals are likely to faucet into this class close to the top of the month whereas promising to make up for it from the following month-to-month fee. Nonetheless, this dangerous behavior will make it unimaginable to economize in the long term.

As an alternative of simply placing cash apart, assign it a goal. Create financial savings classes, so you’ll know what that cash goes to be for.

5. Make It a Behavior

Final however not least, it’s important to make month-to-month price range planning a behavior. Nonetheless, sticking to this behavior takes extra than simply planning your revenue and bills. You’ll have to discover ways to management your spending and keep inside the price range every month. A little bit of self-control follow will allow you to lower your expenses within the long-run.

Preserve Your Belongings Protected

Little doubt planning a price range could make an enormous distinction in your every day life. Nonetheless, moreover simply planning, it’s a must to search for methods to economize. One of many methods it can save you a few bucks on every buy is thru on-line procuring.

Think about using a VPN to entry higher offers from completely different areas, in addition to maintain your on-line data secure when looking the online. What’s a VPN? It’s a device that means that you can safe your web connection and defend your self from hackers. A correct cybersecurity plan is among the greatest methods to stop cyber assaults, which may negatively affect your financial savings.